5G Coverage in Europe: Progress Toward Goals Amid Lingering Disparities

Timely spectrum allocation and proactive policies, not the tyranny of geography or demographics, define Europe’s 5G coverage leaders

Europe is now midway through the 5G technology cycle. Capital spending on network expansion has peaked for most countries, and the flagship low- and mid-band spectrum auctions necessary for 5G deployment are complete. Mobile data traffic growth is now slowing for the first time, and European operators have been more cautious than peers in North America or Asia in adopting new technologies like 5G Standalone (SA), largely due to challenging operating conditions related to sluggish average revenue per user (ARPU) growth.

From a policy perspective, the European Commission has placed 5G at the core of its competitiveness strategy, closely linking coverage availability, timely spectrum assignment, and vendor diversity to productivity gains and strategic autonomy. The EU’s 5G policy agenda is converging on three key imperatives: streamlining infrastructure deployment through initiatives like the Gigabit Infrastructure Act (GIA) and upcoming Digital Networks Act (DNA); subsidizing frontier R&D via programs such as CEF Digital and SNS-JU; and de-risking vendor supply chains through the Security Toolbox and support for open RAN.

This research, which leverages Speedtest Intelligence® data, aims to independently benchmark progress toward the EU’s flagship 5G deployment objectives, including the Digital Decade 2030 goal of achieving 100% outdoor 5G population coverage, using the world’s largest consumer-initiated dataset. It represents the first installment in a three-part series examining Europe’s progress in 5G coverage, network performance, and legacy network sunsets.

Key Takeaways:

- Europe’s 5G rollout has produced a “two-speed” competitiveness landscape, with some countries surging ahead in deployment while others fall behind. In Q2 2025, Nordic and Southern European countries maintained a substantial lead in 5G Availability, fueled by recent 700 MHz band deployments that drove double-digit coverage gains in countries such as Sweden and Italy. By contrast, 5G Availability in Central and Western European laggards such as Belgium, the United Kingdom, and Hungary remains less than half that of the leaders. On average, EU mobile subscribers spent 44.5% of their time connected to 5G networks in Q2 2025, up from 32.8% a year earlier.

- The deployment and adoption of 5G SA in Europe remain sluggish, increasing slowly from a very low base and further widening the region’s gap with North America and Asia. Spain stands out as a clear leader in 5G SA deployment, reaching an 8% Speedtest® sample share compared with the EU average of just 1.3% as of Q2 2025. This progress has been driven by Spain’s proactive use of EU recovery funds to subsidize 5G SA rollouts in underserved areas, with a particular focus on bridging the rural-urban digital divide. However, the U.S. and China are still far ahead, with 5G SA sample shares above 20% and 80% respectively, reflecting a much greater pace of coverage and adoption in those markets.

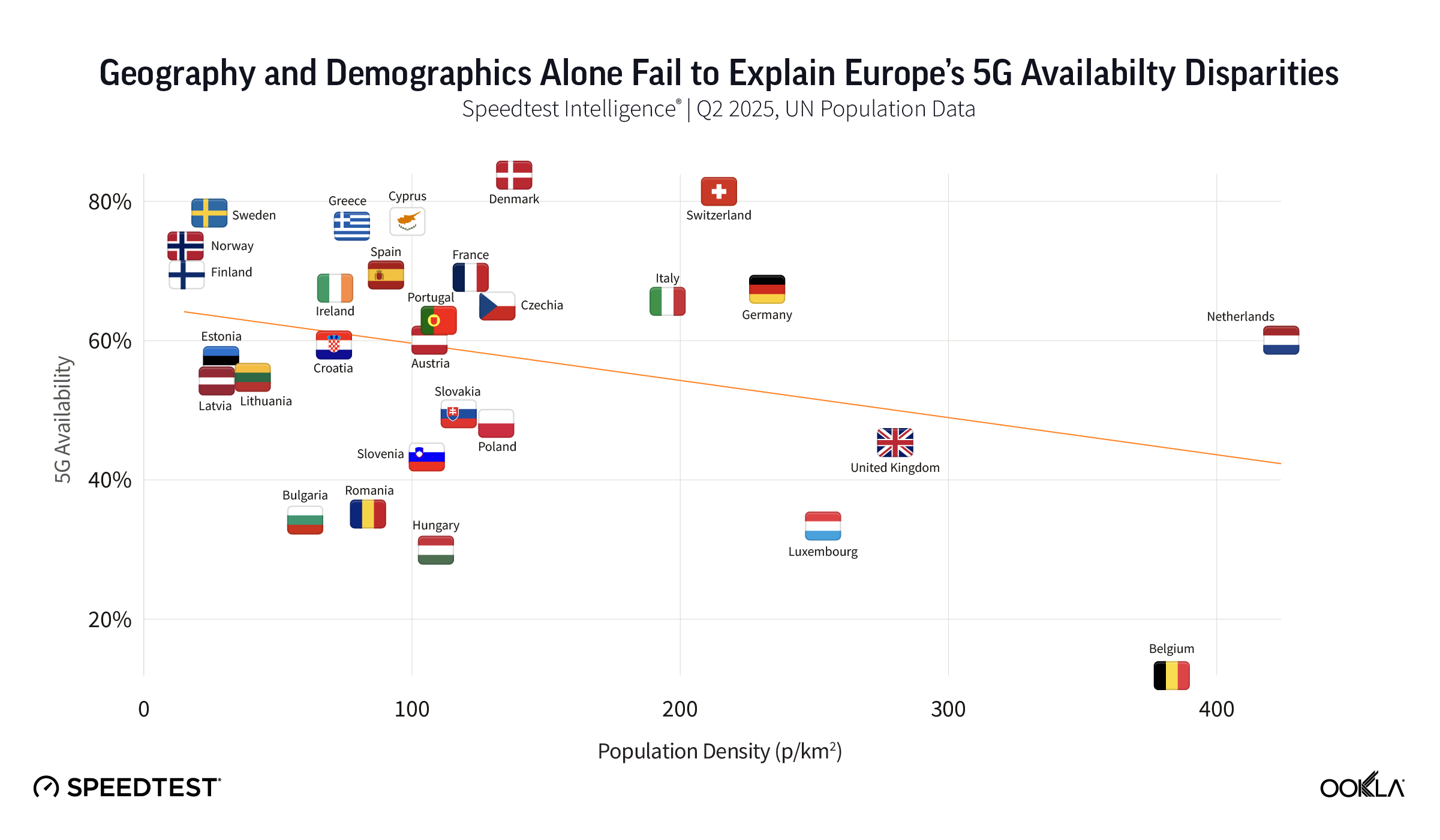

- Fragmented 5G Availability across Europe is driven by a complex mix of national policies on spectrum assignment and broader economic factors, rather than by simple geographic or demographic differences. 5G Availability is more strongly correlated with policy-driven factors such as spectrum allocation timelines and costs, coverage obligations, subsidy mechanisms, and regulations for infrastructure sharing and permitting, than with structural factors like urbanization rates or the number of operators. This indicates that 5G competitiveness is shaped less by technology gaps or inherent market imbalances and more by effective policy execution.

Europe’s recent fulfillment of the 5G pioneer band strategy masks fragmentation

This year is the first time that the EU’s “pioneer bands” for 5G, identified in the Commission’s 5G Action Plan to support early harmonized spectrum availability, have been substantially assigned across the bloc. With recent auctions in Poland for low-band and the Netherlands for mid-band, every member state except Malta has now allocated 60 MHz in the 700 MHz band and 400 MHz in the 3.4-3.8 GHz band for 5G. This effectively completes the 5G auction pipeline in Europe until demand increases for the final pioneer band, the 26 GHz mmWave band (1,000 MHz), which is likely to be used primarily for capacity in-fill in very dense urban environments like stadiums.

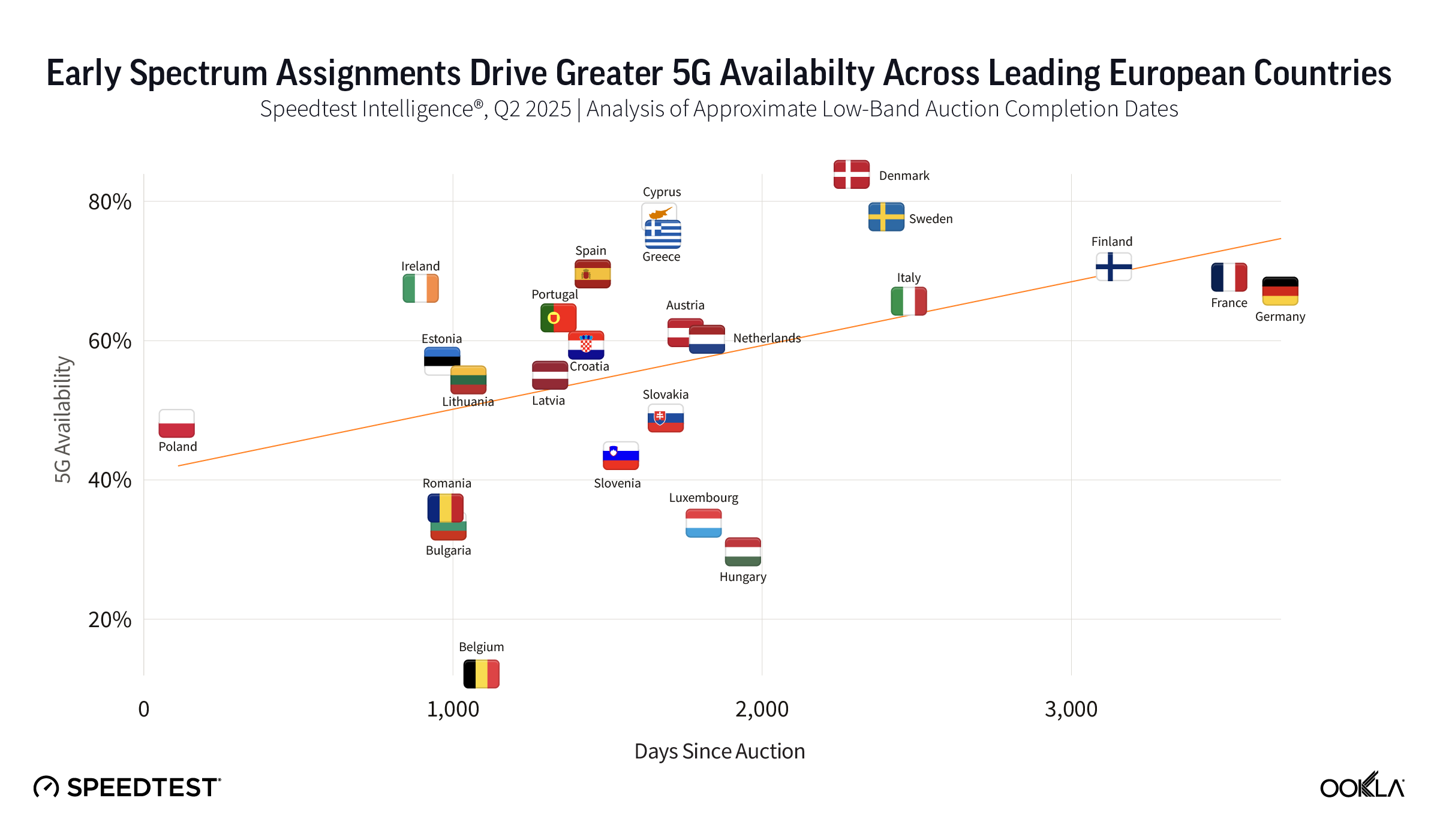

This important milestone in assignment harmonization marks the end of nearly a decade of significant fragmentation in spectrum availability for 5G across Europe, which had undermined the conditions needed for the Commission’s pursuit of a single market for telecom. For example, there was almost a nine-year gap between the 700 MHz assignment in Finland, one of the first movers in 2016, and in Poland, which only completed its assignment earlier this year, despite both countries having committed to the same Digital Decade targets.

Fragmentation remains a persistent theme, shaping stark 5G deployment asymmetries that cannot be explained by geography or demographics alone. Northern and Southern European countries such as Denmark (83.9%), Sweden (77.8%), and Greece (76.4%) are disproportionately represented among the countries with the highest 5G Availability in Q2 2025, with coverage rates up to twice as high as those in Western and Eastern countries like the United Kingdom (45.2%), Hungary (29.9%), and Belgium (11.9%).

Northern and Southern Europe lead in 5G Availability through a carrot-and-stick mix of spectrum management, subsidies, and coverage obligations

Nordic countries such as Denmark, Sweden, and Norway—with Sweden and Norway featuring some of the lowest population densities and most challenging terrain in Europe—continue to distinguish themselves in the 5G cycle through innovative policy approaches. All three have imposed stringent rural or regional coverage obligations on 5G spectrum licenses. For example, in Sweden’s 700 MHz band auction, Telia was required to invest €25 million (US$29 million) from its license fee to provide at least 10 Mbps coverage in prioritized rural areas lacking adequate service, with operators aiming for 99% nationwide population access by the end of this year.

These Nordic countries have also actively promoted extensive network sharing, such as the TT Network joint venture between Telia and Telenor in Denmark and Net4Mobility between Tele2 and Telenor in Sweden, and leveraged loans from the European Investment Bank (EIB) or Nordic Investment Bank (NIB) to fund rural rollouts and support early 700 MHz deployments to create a “true” 5G coverage layer rather than relying solely on dynamic spectrum sharing (DSS).

Similarly, Switzerland continues to outpace its Central European neighbors, such as Luxembourg and Belgium, in 5G Availability, reaching 81.3% in Q2 2025. This achievement was realized without government subsidies, relying instead on early, competitively priced access to the pioneer bands and voluntary commitments from operators like Swisscom to deliver extensive 5G coverage (e.g., 90% population coverage by 2024). Affordable spectrum allocation preserved operators’ capital for network investments, bolstered by exceptionally high average revenue per user (ARPU) levels.

Policy acts as a barrier, not a catalyst, for 5G deployment in Western and Eastern European laggards

While regulatory policies have spurred 5G investment in Northern and Southern European countries, they have stifled it in others. In the United Kingdom, the enforcement of the Telecoms Security Act has compelled operators to undertake an expensive rip-and-replace program for vendor equipment in 5G networks by 2027, driven by concerns over supply chain vulnerabilities (with similar impact observed in Hungary). Additionally, the country’s 700 MHz and 3.6-3.8 GHz spectrum auction in 2021 omitted stringent coverage obligations after operators agreed to the voluntary Shared Rural Network (SRN) initiative, which emphasized improving rural 4G coverage rather than accelerating 5G rollout.

These challenges have been compounded by post-Brexit funding gaps, which have prevented the United Kingdom from accessing EU Recovery and Resilience Facility resources, including the €2 billion (US$2.3 billion) allocated for 5G deployment in Italy and the support provided for Spain’s Digital Spain Agenda 2025. At the same time, the country’s operators have been under further pressure from ARPU erosion due to fierce price competition in a four-player market (now changing) and from rising operational costs, especially higher energy prices.

The United Kingdom is not unique in its struggles. Belgium, home to the core of European bureaucracy, still features lower 5G Availability than many emerging markets in Latin America and Southeast Asia. The country’s federal structure led to chronic delays, as spectrum auctions originally planned for 2019 were pushed to 2022 amid regional disputes over revenue sharing between Flanders, Wallonia, and Brussels. Strict radiation limits in Brussels further slowed 5G deployment post-auction.

Analysis of the relationship between 5G Availability and spectrum auction timing in Europe confirms that policy can act as a barrier to deployment when it unduly delays spectrum release. Many operators have used techniques such as DSS to accelerate 5G rollouts before dedicated pioneer bands were available (resulting in some artificial overperformance in countries such as Ireland and Poland). However, the evidence clearly shows that countries which assigned pioneer bands earlier have achieved higher levels of 5G Availability today.

Low-band deployment and DSS use continue to lift 5G availability in lagging countries

Recent advances in 5G Availability have been driven by low-band deployments and the use of DSS, raising the average proportion of time spent on 5G networks in the EU from 32.8% in Q2 2024 to 44.5% in Q2 2025. The pace of coverage growth, and the corresponding increase in 5G usage, has primarily reflected each country’s starting point. Lagging countries like Latvia, Poland, and Slovenia have seen double-digit gains in 5G Availability from a low base. By contrast, leading countries such as Switzerland and Denmark, where 5G coverage is now nearly ubiquitous, have shifted their focus to targeted capacity upgrades through site densification and mid-band expansion.

Significant 5G coverage gains in Sweden (+21.3% YoY in 5G Availability) over the past year have been driven by aggressive 700 MHz deployment by Telia and Tele2 to close rural-urban gaps across the country’s expansive forested terrain, with fiscal backing from government digital inclusion subsidies. In Italy (+20.5% YoY), momentum has come from 3G sunsets (with WindTre repurposing the 2100 MHz band recently), mobilization of EU Recovery Funds through the country’s flagship National Recovery and Resilience Plan (PNRR), and April 2024 policy reforms easing EMF restrictions to facilitate faster infrastructure rollout. Meanwhile, Malta’s operators have rapidly expanded 5G coverage through DSS and benefited from the country’s compact geography, despite still lacking a 700 MHz assignment for 5G.

Low-Band Deployment and DSS Fuel 5G Coverage Expansion in Lagging Countries

Speedtest Intelligence® | Q2 2024 – Q2 2025

Subsidies push Spain to the front in 5G SA as Europe slips behind U.S. and China

While the European Commission has not yet embedded technology-specific deployment goals for 5G SA in its 2030 Digital Decade policy program, it is now distinguishing the technology from the Non-Standalone (NSA) architecture in several key policy documents, funding initiatives, and monitoring reports. This distinction is often framed as an enabling requirement in the context of helping to boost EU competitiveness, closing innovation gaps, and addressing Europe’s lag behind the U.S. and China in advanced connectivity deployment.

However, first-of-its-kind research published by Ookla earlier this year in collaboration with Omdia revealed that the bloc has fallen far behind in 5G SA deployment. Real-world penetration of the technology, shaped by a combination of network coverage, device adoption, and tariff configuration, remains much lower than headline population coverage figures suggest. By Q2 2025, the competitiveness gap had widened further, with 5G SA sample share (a proxy for coverage) reaching just 1.3% in the EU. This is several times lower than the more than 20% observed in the U.S. and 80% in China in the same period.

Spain's Subsidy-Heavy Policy Framework Drives 5G SA Deployment in Underserved Areas

Speedtest Intelligence® | Q2 2024 – Q1 2025

Spain continues to lead Europe in 5G SA deployment, with its 5G SA sample share surpassing 8% for the first time in Q1 2025. Both MasOrange and Telefónica have driven an aggressive nationwide rollout using a diversified spectrum strategy across low- and mid-bands, extending 5G SA coverage deeper into rural and underserved areas than anywhere else in Europe. This progress has been enabled by Spain’s subsidy-heavy policy framework, which has allocated hundreds of millions of euros from EU recovery funds (NextGenerationEU) through “UNICO-5G” grants to finance more than 7,000 new sites in villages and along 30,000 km of roads.

Key European economies such as the United Kingdom and Germany are achieving stronger progress in 5G SA deployment than their overall 5G Availability figures, which are heavily skewed by NSA networks, might indicate. The United Kingdom’s Wireless Infrastructure Strategy sets out a national ambition, rather than prescriptive obligations, to achieve 5G SA coverage in all populated areas by 2030. This target is among the most ambitious of any advanced liberal economy globally. The country has also leveraged remedies addressing competition concerns over the VodafoneThree merger to require the merged entity to extend 5G SA coverage to 99% of the UK population by 2030.

Meanwhile, the German telecom regulator BNetzA has promoted competition in the 5G SA rollout by being one of the first globally to transparently track 5G SA deployment with detailed operator-level coverage maps available to the public.

Evidence-based policymaking is central for Europe’s competitiveness in frontier technologies like 5G

Persistent disparities in 5G coverage and long delays in harmonizing spectrum availability show that upcoming regulatory initiatives like the DNA face a tall order to improve Europe’s competitiveness in 5G deployment. Yet the experience of member states that moved early on strategic spectrum allocation and applied data‑driven policy levers to spur deployment, often overcoming geographic and demographic disadvantages traditionally seen as impediments, demonstrates that Europe already has the tools needed to close the gap.

Coming next in this three-part series: a Europe‑wide 5G performance study spanning QoS (speeds, latency) and QoE (browsing, video, gaming) built on the world’s largest consumer‑initiated dataset. Stay tuned.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.